Net Zero Stocktake 2023

Assessing the status and trends of net zero target setting across countries, sub-national governments and companies.

11 JUN 2023

If Phase One of net zero was about accepting the scientific principle of net zero and Phase Two about pledges aiming to get there, the much more consequential Phase Three is about delivery. For the over 4,000 entities currently in the Net Zero Tracker database, the last year confirms there is nowhere to hide.

In November 2022, the UN Secretary-General’s Expert Group set out what ‘good' net zero looks like; in June 2023, the UNFCCC established the Global Climate Action Recognition and Accountability Framework for non-state entities. Nations, regions and corporates that have set long-term targets, but are doing nothing concrete to meet them, are coming under more scrutiny than ever.

Net Zero Stocktake 2023 is our third comprehensive annual report of net zero target intent and integrity across all nations, all states & regions in the largest 25-emitting countries in the world, all cities with 500,000+ inhabitants, and the largest 2,000 publicly-listed companies in the world. We lift the hood on net zero trends globally, including assessing the number of major governments and companies that have pledged net zero, the number that have not, and, most importantly, those that have pledged but not yet delivered on important markers of credibility.

Key findings

- Growth in the number of national and subnational net zero targets has slowed, but company net zero target-setting momentum continues at speed.

- The share of large publicly-listed companies with net zero targets has more than doubled in a little over two years, from 417 to 929.

- National government net zero targets underpinned by legislation or policy documents increased substantially in the two-and-half years, from 7% to 75%.

- A significant share of subnational and corporate entities still lack any emission reduction target whatsoever, at the global level and within the G7.

- Collectively, there are very limited signs of improvement in the robustness of subnational and corporate net zero targets and strategies.

- More entities are clarifying their intention to use carbon dioxide removals (CDR) in their value chain.

- Despite having net zero pledges, no major producer countries or companies have committed to phasing out fossil fuels.

- Emerging voluntary net zero standards have strongly converged on principles, but more specificity is required to give clarity to those wanting to set credible strategies.

Of the over 4,000 entities we currently track, at least 1,475 now have a net zero target, up from 769 in December 2020.

National government net zero targets underpinned by legislation or policy documents increased substantially in two-and-half years. Today, 72 countries have net zero targets either enshrined in legislation or outlined as a goal in policy documents.

A majority of non-state entities have yet to set a net zero target

Strikingly, a significant share of subnational governments and company entities still lack any emission reduction target whatsoever — at the global level and within the G7. At the corporate level, the EU is well ahead of the US on net zero target setting.

In total, we could not identify any emission reduction target for four UNFCCC member states, 439 states & regions in the top 25 emitting countries, 766 major cities, and 734 of the world's largest publicly listed companies.

At the sectoral level, we found that the Biotech, Health Care & Pharma (44%), Infrastructure (46%), and Retail (26%) sectors have particularly high percentages of companies without any emission reduction target at all. Unsurprisingly, the same three were among the worst performing sectors on net zero target-setting: less than 40% of companies in these sectors have net zero targets, compared with, for example, Power Generation (71%) and Fossil Fuels (67%).

Net zero integrity?

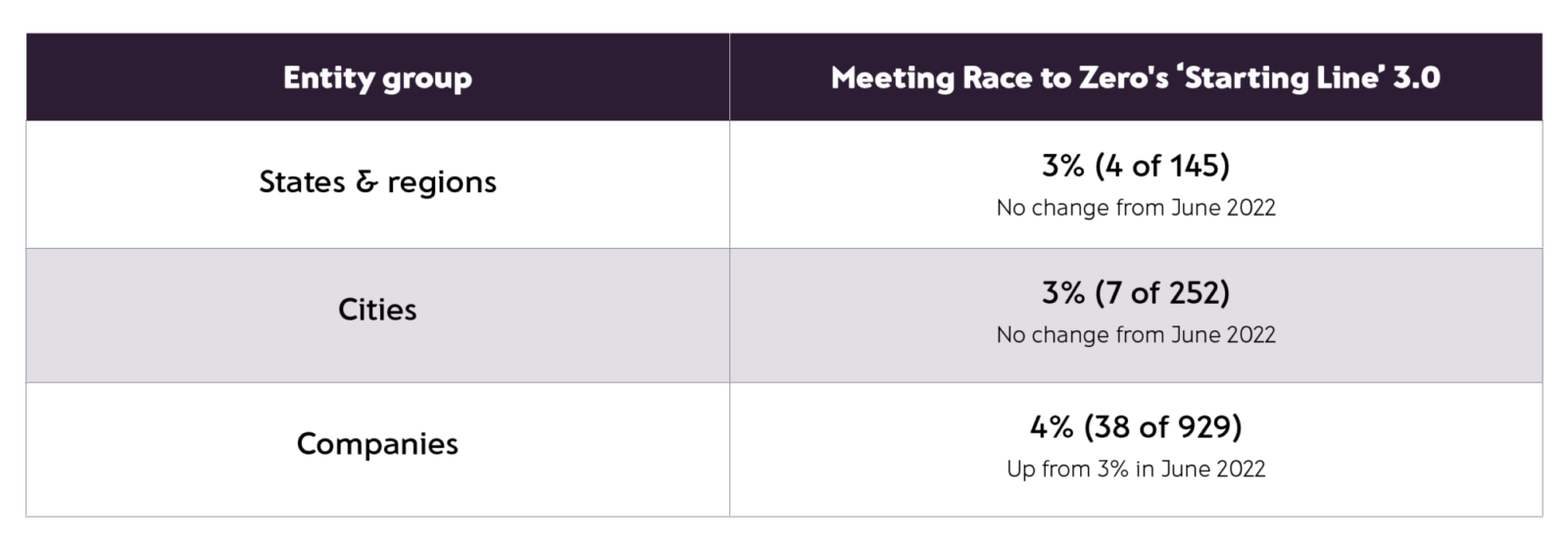

Collectively, there are very limited signs of improvement in subnational and corporate net zero integrity. We observed essentially no progress on the percentage of entities that meet all six Race to Zero criteria: (1) set a specific net zero pledge (by 2050 for entities within OECD countries); (2) include all GHGs (all emission scopes in case of companies); (3) clarify conditions on the use of offsetting; (4) publish a plan on how it intends to achieve its interim and long-term targets; (5) implement an immediate action to proceed on its commitments (6) publish annual progress reports on both their target achievements and measures undertaken annually.

For companies, several recent analyses highlight the lack of Scope 3 emissions coverage and the unregulated use of offsets as key concerns that undermine the integrity of corporate net zero targets, which is why they became part of the starting line criteria of the Race to Zero campaign from June 2022.

More entities are clarifying their intention to use carbon dioxide removals (CDR) within their value chain. At least 25% of companies plan to use CDR to achieve their targets. This number includes corporates that plan to procure carbon credits from CDR projects outside their value chain and companies that invest in CDR within it, also referred to as 'insetting.'

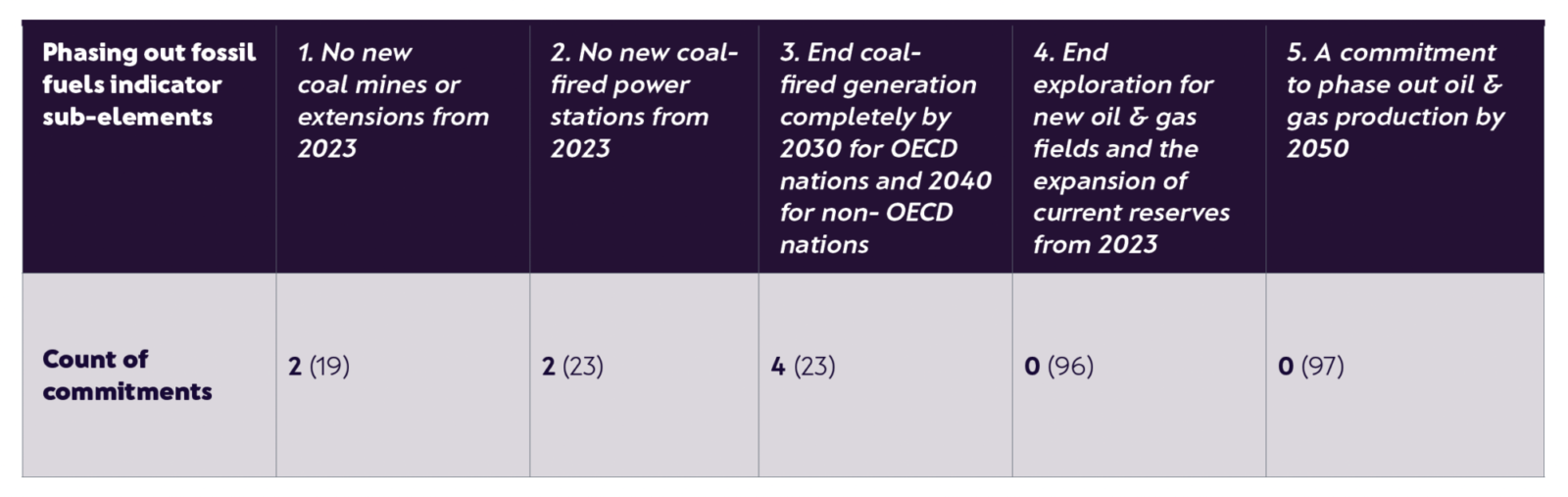

Both the IPCC and IEA have shown that deep cuts in fossil fuel consumption and production are essential components in achieving net zero and delivering the Paris Agreement temperature targets.

Despite the bulk of the 114 Fossil Fuel companies in our database having net zero targets, we found that none of these companies plans to fully transition away from their fossil assets or associated businesses. These companies could reflect on the UN Expert Group’s fifth recommendation that a fossil-fuelled future is incompatible with what 195 nations agreed to when they signed the Paris Agreement.

Net zero standards convergence

In the absence of universal and binding net zero-related policy and regulation, emerging voluntary standards and initiatives have provided guidance to company entities on how to pursue net zero with integrity.

Section Four of our report provides an overview of key documents on company net zero targets released since COP26, including the UN Expert Group (HLEG), the ISO Net Zero Guidelines, the UN Race to Zero campaign's Starting Line and Leadership Practices 3.0 criteria, the Science Based Target initiative's Corporate Net Zero Standard, and the Corporate Climate Responsibility Monitor 2023 methodology.

Broadly, guidance converges at the high-level, but more specificity is required to make pathways clearer for all entities wishing to set credible and robust net zero targets.

Net zero has had to grow up quickly, but is now firmly in an age of implementation. As the United Nations climate talks focus this year on taking stock of collective progress towards the Paris Agreement goals, we offer three conclusions from our analysis for reflection:

- A majority of entities, eight years after the Paris Agreement was signed, have yet to set a target aligned to its goals

- Those entities that have set a target now need to urgently make it a robust strategy, aligned to the requirements of science

- The clear consensus that has emerged on what is required for robust net zero targets, serving as a guiding star for both commitments and implementation.

Above all, we need more entities to sign up to net zero, and need those that have pledged to step up.